What Is A Nonprofit

A nonprofit is a legal entity that is created and operated for a collective, public, or social benefit.

There is a common misconception that nonprofits do not make money. This is an understandable assumption based on the name, but the reality is a bit different. Many nonprofits make quite a bit of money and are big businesses. In fact, nonprofits are Americas third-largest employer.

Nonprofits include more than the homeless shelter or food pantry down the street it also includes your nearest hospital, church, library, and Chamber of Commerce, to name only a few. According to the Internal Revenue Service , there are 27 different types of 501 and 5 other types of organizations. These organizations are exempt from federal income taxes and have a significant impact on your community.

The one rule that all nonprofit organizations must follow to remain tax-exempt is not paying out profits. The IRS states that no part of the organizations net earnings can benefit any private shareholder or individual. This means no shareholders that can get rich from the organization.

In some states, nonprofits are allowed shareholders, but these individuals do not take a salary. Instead, they are often organization founders who hold onto control over the organization through their shares and voting power.

Employer Identification Number For Churches

Every tax-exempt organization, including a church, should have an employer identification number whether or not the organization has any employees. There are many instances in which an EIN is necessary. For example, a church needs an EIN when it opens a bank account, to be listed as a subordinate in a group ruling or if it files returns with the IRS .

An organization may apply for an EIN by filing Form SS-4, Application for Employer Identification Number, according to its instructions. If the organization is submitting IRS Form 1023, Application for Recognition of Exemption Under Section 501c3 of the Internal Revenue Code, the EIN should be listed on the form.

The Legal Limits For Churches

The law requires churches to operate mainly for religious reasons. That means they must steer clear of political lobbying and from officially endorsing any particular candidate running for public office. Furthermore, churches that openly speak against anything the government legalizes, even declarations considered immoral by the church system, such as same-sex marriage, abortion, and euthanasia, will forfeit their tax-exempt status.

Read Also: What Is Best Bible App

Inurement And Private Benefit Of Churches

Inurement to Insiders Churches and religious organizations, like all exempt organizations under section 501c3, are prohibited from engaging in activities that result in inurement of the churchs or organizations income or assets to insiders . Insiders could include the minister, church board members, officers, and in certain circumstances, employees.

Examples of prohibited inurement include:

- the payment of dividends,

- the payment of unreasonable compensation to insiders

- and transferring property to insiders for less than fair market value.

The prohibition against inurement to insiders is absolute therefore, any amount of inurement is, potentially, grounds for loss of tax-exempt status. In addition, the insider involved may be subject to excise tax. See the following section on Excess benefit transactions. Note that prohibited inurement doesnt include reasonable payments for services rendered, payments that further tax-exempt purposes or payments made for the fair market value of real or personal property.

Church Private Benefit A section 501c3 organizations activities must be directed exclusively toward charitable, educational, religious or other exempt purposes. The organizations activities may not serve the private interests of any individual or organization. Rather, beneficiaries of an organizations activities must be recognized objects of charity or the community at large .

What Are The Benefits Of 501 For Churches

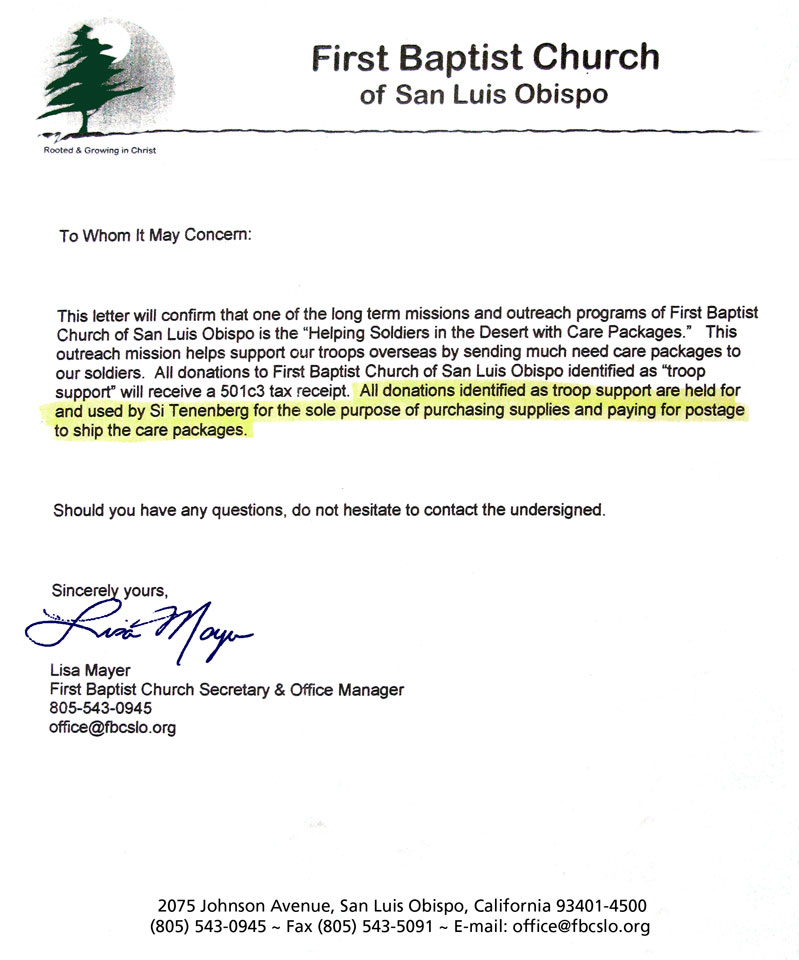

Registering a church as a nonprofit with the IRS establishes its ability to meet the 501 church requirements and qualifications as a charitable nonprofit organization. Even though there is no requirement to do so, many churches seek the benefits from registering as a 501, such as:

- Receiving a letter from the IRS designating that the church is tax exempt

- Assuring donors that their contributions are tax deductible

- Depending on their state, they may be exempt from state employment, sales, and/or income taxes

- Exemption from paying federal unemployment tax

- Availability of tax-exempt financing and reduced postal rates

- Providing proof of 501 status to qualify for nonprofit discounts from businesses

Another benefit of registering includes qualifying for free online donation tools like Subsplash Giving. Adding an online giving optionincreases church donations by an average of 32% and streamlines administrative tasks like sending tax statements!

Don’t Miss: How To Start Reading The Bible Daily

My Dear Friend: Hosting A Candidate

Some pastors introduced candidates during their sermons and allowed them to speak, while others interviewed them during church functions. The Johnson Amendment allows candidates to visit churches and speak to parishioners before elections, but it requires that churches maintain a nonpartisan atmosphere and give all candidates the same opportunity to visit.

St. Luke “Community” United Methodist Church

Location: Dallas

Pastor: Richie Butler

Context: On Oct. 23, a day before early voting began, Democratic gubernatorial candidate Beto ORourke visited the church. Butler introduced him as the next governor of Texas. He told parishioners: We want to encourage him as he continues to run the race that is before him, and he needs us to get him across the finish line. ORourke urged parishioners to vote and then gave a brief speech calling for fixing the states electric grid and expressing alarm over the high rate of school shootings and gun violence.

Expert Assessment:

Mayer: This situation is a clear violation of the Johnson Amendment. Beto ORouke is introduced as the next governor of Texas, which highlights both that he is a candidate and one whom the church supports. And ORourkes comments are a sales pitch for his candidacy. There is no indication that any opposing candidate has been given a similar opportunity and, even if he had been, the favorable introduction of ORourke would still be across the line.

Grace Woodlands

Location: The Woodlands

About The Tax Exempt Organization Search Tool

The online search tool allows you to search for an organization’s tax exempt status and filings in the following data bases:

The information on the organizations are produced from computer records and is subject to certain limitations, particularly in the format and arrangement of the entries.

Searching by EIN

- The dash after the first two digits is optional for entering the employer identification number

Searching by organizations name

- Fields are not case-sensitive.

- Include the entire or part of the name in quotation marks. For example, to search for Anytown General Hospital, enter “Anytown General Hospital” or “Anytown General”.

- Avoid common words such as the or Foundation.

- Organizations are listed under the legal name or a doing business as name that are on file with the IRS. Common or popular names of an organizations are not on file.

- In the Publication 78 data, doing business as names of organizations are not listed.

Note: If you are not getting the result you want, try sorting by city, state or zip.

Search the Auto-Revocation List

To narrow your search, use the date format MM-DD-YYYY or select a data range on the calendar.

- For example, to find an organization whose revocation was posted on the 12th or 13th of the month, enter a search range of MM/11/YYYY to MM/14/YYYY.

Note: Date range searches are not inclusive.

Searching organizations with foreign addresses

Due to the different structure of foreign addresses, data is sometimes found in an unexpected location.

Recommended Reading: What Does Ad In The Bible Stand For

How Does A Church Get A 501

Once approved, the church can obtain an Exempt Organization Determination Letter from the IRS confirming its tax-exempt status. This letter is public information available on the IRS website. It also can be used to help establish a churchâs 501 status when requested by state governments, businesses, and other organizations to establish tax exempt status.

A Complete List Of Types Of Nonprofits : Which One Should You Start

Ask one hundred people what a nonprofit is, and you will get one hundred different answers. This confusion may be because of the variety of types of nonprofits. And the name nonprofit itself can be confusing. While most people assume a nonprofit to be a charitable organization, many different types of organizations are classified under this title. The detailed list in this blog will give you a better idea of where your organization can fit and what federal benefits you can receive.

Before we begin, let us explain what a nonprofit is and as per the IRS, how it must operate.

Recommended Reading: Where To Start Reading The Bible For New Believers

How To Apply For Church 501c3 Tax

The process of applying for church or ministry 501c3 exemption through 501c3 application is covered in detail throughout this website and its exactly the same as any other nonprofit. However, churches and religious organizations have somewhat different compliance requirements which Ive detailed in the following articles that specifically apply to religious entities:

Churches are also required to complete the Form 1023 Schedule A.

How Do You Start A 501

To create a 501, you must define the type of organization and its purpose or mission. Before selecting a name, search to ensure that it is not taken. If available, secure the name by registering it with your state. Otherwise, secure the name when filing the articles of incorporation. The articles of incorporation must be filed with the state in which it will be organized and according to the state’s rules for nonprofit organizations.

After filing, apply for the 501 IRS exemption and state tax exemption for nonprofit organizations. Upon completion, create your organizations bylaws, which specify how the organization will be structured and governed. Finally, appoint and meet with your board of directors.

Read Also: How To Read Your Bible Daily

What Is A 501

Wikipedia defines it this way:

“501 organization is a organization fas, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 of Title 26 of the United States Code. It is one of the 29 types of 501 nonprofit organizations in the US.”

Additionally, there are two types of 501c3:

- A public charity, identified by the Internal Revenue Service as “not a private foundation”, normally receives a substantial part of its income, directly or indirectly, from the general public or from the government. The public support must be fairly broad, not limited to a few individuals or families. Public charities are defined in the Internal Revenue Code under sections 509 through 509.

- A private foundation, sometimes called a non-operating foundation, receives most of its income from investments and endowments. This income is used to make grants to other organizations, rather than being disbursed directly for charitable activities. Private foundations are defined in the Internal Revenue Code under section 509 as 501 organizations, which do not qualify as public charities.

Record Keeping Requirements For Churches

All tax-exempt organizations, including churches and religious organizations , are required to maintain books of accounting and other records necessary to justify their claim for exemption in the event of an audit. See Special Rules Limiting IRS Authority to Audit a Church. Tax-exempt organizations are also required to maintain books and records that are necessary to accurately file any federal tax and information returns that may be required.

There is no specific format for keeping records. However, the types of required records frequently include organizing documents and , minute books, property records, general ledgers, receipts and disbursements journals, payroll records, banking records and invoices. The extent of the records necessary generally varies according to the type, size and complexity of the religious organizations activities. Please read the following for further information on 501c3 record keeping and accounting requirements.

Read Also: Where Is The Book Of Daniel In The Bible

Can A Church Qualify As A 501 Through Their Denomination Or Association

If your church is affiliated with a centralized parent organization , you should ask them if they have secured a âgroup rulingâ for a group exemption.

Church parent organizations can file for group rulings to identify their affiliated churches and automatically provide them with tax-exempt organization status. Churches on these lists do not need to take any more steps to obtain recognition as a designated 501 nonprofit from the IRS.

The good news about Section 501 is that churches are considered exempt from federal taxes whether they register or not with the IRS. As long as your church adheres to the IRSâs tax exemption status requirements, your donors can deduct their donations when they file their personal tax forms.

Subsplash is committed to helping your church grow and Fuel Your Missionâ¢. Subsplash Giving guarantees that your donations will increase by allowing your donors to give on your website, mobile app, or through text-to-give. Better yet, there are no monthly fees, and Subsplash Giving offers the best rates in the industry with GrowCurveâ¢!

To find out how Subsplash can help encourage generosity, letâs chat!

What Is A 501 Church

The term â501â comes from the Internal Revenue Code Section 501 that provides churches and religious organizations with federal tax-exempt status.

The expression â501 churchâ commonly refers to churches that qualify for this tax-exempt status through one of the following ways:

- Applying and being registered as a 501 organization with the IRS

- Meeting the requirements established by the IRS in section 501

Don’t Miss: What Does The Bible Say About Worry

What Are The Benefits Of Google Maps

Give your finger a break

All you need to do is to save your home and office addresses in Google Maps, and the system will automatically fill them in as you type, speeding up your search. You can also allow the Google Maps app to access your Android and iPhone address books to quickly find saved addresses.

Google Maps for Android and iOS devices was released in September 2008 and features GPS turn-by-turn navigation along with dedicated parking assistance features. In August 2013, it was determined to be the world’s most popular app for smartphones, with over 54% of global smartphone owners using it at least once.

Never mind traffic jams

Carpool

Integrate Google Maps directly into your ride-sharing APP for reliable, real-time routing, providing drivers with a smooth navigation experience while reducing passenger wait times.

Adjust the route in real time

Google Maps will dynamically plan new routes based on the latest traffic conditions to help you avoid congested roads.

Help your drivers get from point A to Z faster and safer

What Is The Difference Between A 501 And A 501

A 501 organization is a nonprofit organization established exclusively for one of the following purposes: charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, or preventing cruelty to children or animals. These organizations are mostly prohibited from engaging in lobbying. Alternatively, 501 organizations, which are also nonprofit, are social welfare groups and allowed to engage in lobbying.

You May Like: How To Get To Heaven Bible Verses

How Long Does It Take To Get A 501 Determination Letter

A determination letter is sent after applying for the 501 exemption. The IRS will only say that applications are processed as quickly as possible and are processed in the order received by the IRS. However, it does provide a list of 10 tips that can shorten the process.

Anecdotally, the website BoardEffect, which offers software designed to make the work of their boards of directors easier, more efficient and more effective, says it can take as little as two to four weeks if you can file Form 1023-EZ. However, those who must to file Form 1023 will likely wait for anywhere from three to six months to get their letter, while in some cases the wait can be as long as a year.

Praising Trump Before The 2020 Election

In the days leading up to the 2020 election, some pastors extolled the ways in which former President Donald Trump had delivered for Christians.

Location: Corsicana

Pastor: Derek Rogers

Context: On Oct. 14, 2020, Rogers told his congregation that even though pastors arent supposed to talk about politics, parishioners needed to support Trumps reelection bid. I do not understand how anybody that calls himself a Christian could vote for the agenda and the platform of Joe Biden, he said. President Trump, he aint the greatest dude in the whole world, but hes the closest thing that we got to what we need.

President Trump, he aint the greatest dude in the whole world, but hes the closest thing that we got to what we need.

Derek Rogers, pastor of Cowboy Church of Corsicana in Corsicana

Expert Assessment:

Mayer: This is a clear violation of the Johnson Amendment because it identifies two candidates by name and explicitly tells the congregation for which of them they should vote.

Church response: Rogers did not respond to requests for comment.

Location: Carrollton

Pastor: Steven Ger

Context: Ger explained to congregants why they should support Trump over Biden for president two days before the election. I like what our president has done. He made his promises. And he kept his promises. He later called Trump the most pro-life president ever and said, Vice President Biden would be the most pro-abortion president ever.

Expert Assessment:

Trinity Family Church

You May Like: What Is The Best Bible Verse For Strength

Black Lung Benefit Trusts

The Federal Black Lung Benefit Act was passed by Congress in 1969. It forced coal mine operators to pay benefits to miners who suffered from the disease because of long-term exposure to coal dust. In 1977, Congress amended the code to create a trust fund for these benefits. These trusts are funded by coal mine operators and pay premiums for insurance, accident and health benefits for coal miners and their spouses, and administrative and incidental expenses.

What Can Google Maps Do For Users

1.Build maps experiences throughout the world

Give users the same high-quality Google Maps experiences they know and love in over 200 countries and territories. Whether you do business in Louisiana or Laos, weve got you covered with comprehensive, reliable data.

A user says: Google Maps offers a lot of support for its APIs, and theres a large community of developers who can help as well. Google does maps best. Choosing it was an obvious choice.

You May Like: What Is An Hcsb Bible