What Do You Mean By Church Exemption From Property Tax

The Emancipation of the Church is codified in Section 3 and Section 5 of the California Constitution. Article 3 is exempt from property tax on buildings, land and equipment used only for religious purposes. The declaration exemption applies to buildings under construction and related land and equipment, provided that the intended use entitles the property to be exempt. A separate regulation also applies to the parking of people attending church services.

There are several important characteristics of church denial that are worth mentioning:

- Exclusive Use Requirement: The exclusive requirement in Section 3 makes church denial a restricted option for churches interested in using it. If you want to rent space for non-religious events such as community meetings or parking, you may lose your right to an exemption.

- Filing Requirements: The church must apply for exemption from the church by filling out a form with the district assessor every year. In order to take full advantage of these benefits, submissions must be made before February 15th of each year.

- The Exception on Rental Properties in Limited Circumstances: If a church rents a parking lot or building for religious activities and the rent is subject to property tax, it can apply for church exemption of the property, but only churches with no more than 500 members and other conditions.

Pros If The Government Taxed Churches:

Fortunately, there are no pros that the government receives if they tax churches. The current legislature of the United States of America states that organizations cannot be taxed, and churches are also a part of organizations. Moreover, taxing these organizations would mean going against the legislature that is unlawful.

Sep Churches: To Pay Or Not To Pay Property Taxes

Churches are some of the biggest landowners in the United States. They own not only religious buildings, but also schools, hospitals, and nursing homes. In most cases, these properties are exempt from property taxes. The reasoning behind this exemption is that churches provide a public good by ministering to the spiritual needs of the community. They also provide social services, such as food and clothing banks, which would otherwise have to be provided by the government. However, there is a growing movement to challenge this exemption, on the grounds that it gives churches an unfair advantage over other businesses. In some cases, churches have been able to avoid paying millions of dollars in property taxes. The debate over whether churches should be exempt from property taxes is likely to continue, as the need for government services increases and the cost of providing them rises.

Since 1894, churches have been exempt from paying federal income taxes, as well as property taxes in all 50 states.

Pennsylvania is particularly difficult for churches to obtain a property tax exemption. An exemption is generally limited to the building where worship is held, and it is not frequently granted to any portion of the building.

Recommended Reading: Bible Verses Fruits Of The Spirit

Title 32 Revenue And Taxation Chapter 361 Property Tax Nrs 361125 Exemption Of Churches And Chapels

NRS 361.125 Exemption of churches and chapels.

1. Except as otherwise provided in subsection 2, churches, chapels, other than marriage chapels, and other buildings used for religious worship, with their furniture and equipment, and the lots of ground on which they stand, used therewith and necessary thereto, owned by some recognized religious society or corporation, and parsonages so owned, are exempt from taxation.

2. Except as otherwise provided in NRS 361.157, when any such property is used exclusively or in part for any other than church purposes, and a rent or other valuable consideration is received for its use, the property must be taxed.

3. The exemption provided by this section must be prorated for the portion of a fiscal year during which the religious society or corporation owns the real property. For the purposes of this subsection, ownership of property purchased begins on the date of recording of the deed to the purchaser.

Disclaimer: These codes may not be the most recent version. Nevada may have more current or accurate information. We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. Please check official sources.

What If We Taxed Churches

Jared Walczak

If churches paid taxes, runs a popular claim on social media , everyone would only have to pay 3 percent taxes. Other claims put the forgone tax revenue haul at $76 billion or $85 billion, oddly specific figures conspicuously lacking a meaningful citation but likely stemming from an error-ridden calculation inFree Inquiry magazine. Whether spurred by a belief that government is improperly favoring religious institutions, an antipathy to wealthy celebrity pastors, or a hope that taxing houses of worship could bring down personal tax bills, the taxation of religious bodies is hotly debated online, but barely on the radar of actual elected officials.

But is that true? How much, if any, tax revenue is forgone, and what do the policies look like? Excitable Twitter users may walk by faith and not by sight in this debate, but lets take a step back from the rhetoric and see whats true, whats exaggerated, and whats outright false about the tax treatment of churches and other houses of worship.

Read Also: Where In The Bible Does It Say Pray Without Ceasing

No Taxes As Churches Are For The Public:

If we morally look at this matter, we conclude that it is wrong to take taxes from the church. Churches are a source of spiritual enhancement for the public and a place of worship for them, so, therefore, it is just unethical and unlawful for the government to take taxes from churches. Churches are solely for the people and are also run the people, not the government. So due to such reasons, the government of the Unites states decided that they would exempt the churches from paying taxes.

In simple terms, taxes are applied to any organization or person making a profit. If we analyze churches, we find out that churches are not involved in any activity that has anything to do with business. It means that churches do not create profits, and so they are exempted from paying taxes. They are donations that are donated to them the public. The earnings are spent back on the residents in some way.

Do Churches Pay Property Taxes A Helpful Guide

For an organization like a church, seeming trustworthy should be a number one priority. After all, you can only positively impact your community if they trust your influence in the area. Also, trust leads to loyalty, and you need this from your members to help you achieve your congregations goalsfrom sharing about your faith to helping the less privileged.

To ensure you maintain trust in your name and brand, church leaders need to continually review their position and activities regarding the payments of taxes. Yes, there are many areas where charitable organizations like churches are exempt. But never take an exemption for granted or assume it applies to all aspects of your activities!

The question of do churches have to pay property tax? is a common one when discussing this aspect of church management. We compiled an easy reference guide to help you understand what the government may expect of you.

Don’t Miss: What Is Sacrifice In The Bible

Church Employees And Social Security Taxes

Since most clergy staff are seen as self-employed, the church is not responsible for minister FICA tax responsibilities.

The 7.65% FICA tax wont be withheld from the ministers pay, and when filling out their W-2 form, boxes 3-6 should be left blank.

While they may not pay the 7.65% FICA tax, they do still need to pay the 15.63% SECA tax.

If some particular public insurance policies are opposed by the belief of the church, a minister can file a form to the IRS to become exempt from self-employment taxes for their ministerial earnings.

However, once the exemption is granted the decision is irreversible. Once you opt-out there is no way to opt back into the policy.

Churches Have Become Businesses

Let me repeat that again. Churches are not non-profits, nor are they charities. Churches in the United States are businesses. They function like a business. They make money like a business. Not taxing them like a business is giving them preferential treatment because they are a religious business

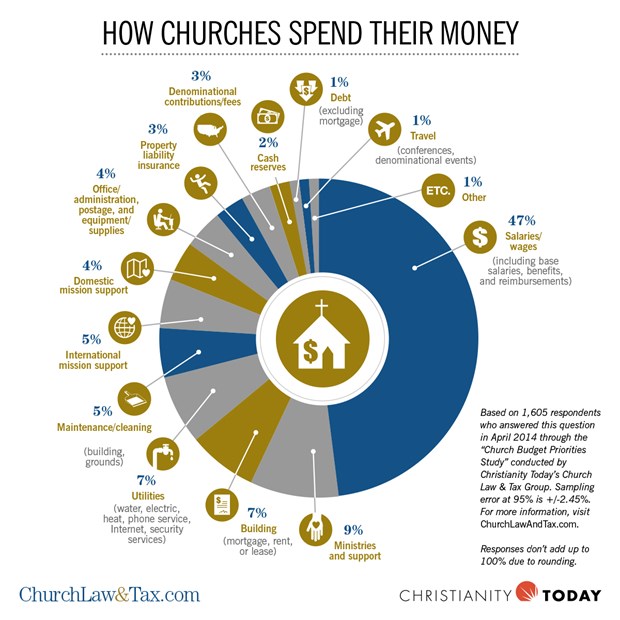

To illustrate this point, lets look at a churches budget.2

- 58% of the budget goes to personnel expenses. Thats over half, simply to pay people working at the church.

- 18% goes to the building.

- 6% is spent on office supplies

- 3% is spent on misc things.

- 14% is spent on programs.

Lets take a closer look at that last one, cause it seems like a good number. Churches are tax-exempt because they provide services to the community, right? How much are they spending? On average, 3%. Only 3% of a churchs budget is used to help the community. And 2% of that is international. Churches are exempt from paying taxes because 1% of their income is used to help the local/national community. If I use 1% of my income for that, can I be tax exempt as well?

Recommended Reading: What The Bible Says About Love

What Would Happen If Churches Would Give Taxes

Everyone is taxed, and these taxes help in running the country. Religious organizations such as churches are not taxed. Have you ever thought that if these churches were taxed, how much revenue would they generate? A study carried out by the University of Tampa stated that the United States of America could receive up to 83.5 billion dollars in additional tax collection if religious organizations such as churches.

This amount is not even close to getting the United States near to universal healthcare, but it can help in fighting poverty in the United States and the rest of the world. It is impossible to apply taxes on churches in a country such as the United States. It is because almost half of the population of the United States of America visits the church at least once every month.

No Taxes Due To Sphere Of Authority:

This idea dates back to the tax codes of the modern era. In the United States, three forms of authority apply to both the governing bodies and the public. These authorities are know as spheres or kingdoms. The first authority, which is also the foundation of all powers, is the authority of the family or the household. The second sphere or nation of authority is the state, and the last sphere of power is that of the church. The people in charge of the church are spiritual, whereas the others are worldly.

The role of spiritual authority allows the church to exclude itself from paying any taxes to the government of the United States. Even in todays world, the temporary power of the state is accountable to the church. It leaves us with the result, that the state has no moral authority to apply taxes on the church. This idea is engraving into the constitution of the United States after the first amendment.

The amendment stated that the government was not responsible for constructing a church, and it was not responsible for the running of the church. Moreover, it could not apply taxes on the church and not interfere in matters of the church. These judgments gave the church a separate sphere of authority.

Also Check: Virtuous Woman In The Bible

Problems With Tax Exemptions

Nevertheless, none of that changes the fact that property tax exemptions are a problem. Not only are citizens forced to indirectly support religious organizations, but some groups benefit much more than others, resulting in problematic religious favoritism. Some institutions, like the Catholics and Christians, have billions of dollars in property whereas others, like the Jehovahs Witnesses, own much, much less.

There is also the problem of fraud. Some people tired of high property taxes will send away for mail-order divinity diplomas and claim that, because they are now ministers, their personal property is exempt from taxes. The problem got to be enough that in 1981, New York State passed a law declaring mail-order religious exemptions to be illegal.

Even some religious leaders agree that the property tax exemptions are problematic. Eugene Carson Blake, a former head of the National Council of Churches, complained once that tax exemptions ended up putting a greater tax burden on the poor who could least afford it. He feared that one day the people might turn against their wealthy churches and demand restitution.

The idea that wealthy churches have abandoned their true mission also bothered James Pike, a former Episcopal bishop in San Francisco. According to him, some churches have become much too involved with money and other worldly matters, blinding them to the spiritual calling which should be their focus.

Who Is Exempt From Paying Taxes

When filing for a W-4, does it mean it is exempt from tax? When you file as an exempt taxpayer for federal tax withholding with your employer, you do not make any federal income tax payments during the year. Although the FICA tax remains in effect, taxpayers are exempt.

Income or transactions that are not subject to tax at the federal, state, or local levels can qualify as tax-exempt. Tax-exemption, unlike a tax deduction, does not imply that taxpayers will not owe any taxes. During the tax year, taxpayers are required by IRS Form 1099-INT to report any investment income. For tax year 2018, taxpayers can reduce their capital gains by claiming other capital losses as capital gains. For each year in which a taxpayer may claim capital losses, they are limited to $3,000. The alternative minimum tax returns certain tax-exempt items to your tax return. As a result of the Tax Code, taxpayers are not required to pay federal taxes on capital gains from the sale of a home.

Don’t Miss: Does The Bible Mention Smoking Weed

How Real Estate Values Impact Property Tax Policy

Municipalities with higher local real estate prices and larger populations tend to have lower property tax rates as there are more taxpayers funding the citys pot and floating their operating budget. For example, Toronto has long boasted the lowest tax rate in the province, given its population size and expensive home prices.Similarly, GTA cities and Richmond Hill, round out the lowest three with rates of 0.632908% and 0.659549% respectively, and have among the highest average home prices in the region at $1,352,869 and $1,441,035.

In contrast, the cities with the highest tax rates often have the lowest-priced real estate.

Another factor is the citys commercial-to-residential tax ratio in most municipalities, businesses pay at least double the amount of tax than homeowners, with the Canadian average at 2.73. Generally, a higher commercial property tax rate translates to a lower residential rate, and vice-versa a local council may opt to hike the latter if they feel their community needs to offer more competitive advantages to businesses.To learn more about how property taxes work in Ontario, check out our property tax FAQs for home buyers here.

Home prices:

Home prices are all average prices, except for Thunder Bay, where the benchmark price was used.

Home prices were for October 2021.

Property tax rates:

Property tax rates for 2021 were sourced from each municipalitys website.

About Zoocasa

What Is The Unrelated Business Income Tax

The only situation when churches arent exempt from property taxes is when they participate in certain business ventures unrelated to their religious purpose. In such cases, they must pay the unrelated business income tax .

Any church which gains more than $1,000 by participating in unrelated businesses must complete and submit an Exempt Organization Business Income Tax Return, also known as Form 990-T.

The list of unrelated business activities doesnt include:

- Donor list rental or exchange

Recommended Reading: Rites Of The Catholic Church

The Separation Between Churches And The State:

Another reason why churches do not pay taxes is to create a moral difference between the working of the state and the working of the church. We can agree to the fact that allowing churches not to pay taxes does differentiate them from the state. It has been arguing before that a difference may create between the two bodies if tax rates were visibly lower for churches but this idea was reject most.

Tax evasion for churches promotes a healthy separation between the church and the state.

Do Churches Pay Property Taxes

Churches are typically exempt from paying property taxes. This is because churches are considered to be non-profit organizations and are therefore not required to pay taxes on their property. However, there are some exceptions to this rule and churches may be required to pay property taxes in certain situations. For example, if a church owns a for-profit business, that business may be required to pay property taxes. Additionally, if a church owns property that is not used for religious purposes, that property may be subject to property taxes.

Non-profit and charitable organizations receive preferential tax treatment in the United States. Religious organizations qualify for a variety of tax breaks. Property taxes and donations are two of the most common types of exemptions. Non-religious organizations must also be more transparent about how their money is spent. Reversing the tax would put churches in charge of their own finances. Taxing is, in essence, the ultimate form of control or destruction in the long run. Several organizations, including the American Jewish Congress, have donated to local governments in place of the taxes they would otherwise have to pay.

Also Check: How Do I Start Reading The Bible

How Does A Church Earn Money

Churches may be related to the next world, but they need money to operate in this world. Churches should not pay taxes on their non-labor income, namely donations, gifts, grants, and capital gains. Churches that frequently engage in business activities unrelated to their religious mission may be forced to pay special taxes on their profits, called unrelated business taxable income . Even though, the income that comes from thrift stores, volunteer work, donor lists, cheap gifts, and advertisements are not eligible for UBTI.

One case where the church belongs to UBTI is that it regularly hires its members to plant seedlings in private woodlands and embezzle the money they make. If the churchs total income from unrelated trade or business in a year is $1,000 or more, it must submit Form 990T to the IRS, which is an income tax exemption return.